Payroll tax calculator 2020

It will confirm the deductions you include on your. The payroll tax rate reverted to 545 on 1 July 2022.

Payroll Tax What It Is How To Calculate It Bench Accounting

Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

. Employers have to pay a matching 145 of Medicare tax but only the. For any wages above 200000 there is an Additional Medicare Tax of 09 which brings the rate to 235. Enter up to six different hourly rates to estimate after-tax wages for hourly employees.

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Use your income filing status deductions credits to accurately estimate the taxes. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Thats where our paycheck calculator comes in. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms. Federal Salary Paycheck Calculator.

Starting as Low as 6Month. What does eSmart Paychecks FREE Payroll Calculator do. The maximum an employee will pay in 2022 is 911400.

Figure out the amount of taxes you owe or your refund using our 2020 Tax Calculator. Small Business Low-Priced Payroll Service. The 2020 Tax Calculator uses the 2020 Federal Tax Tables and 2020 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here.

States dont impose their own income tax for tax year 2022. 3 Months Free Trial. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

Free salary hourly and more paycheck calculators. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into. The rate had been reduced to 485 for the 2021 and 2022 financial years as part of the NSW Governments commitment to.

The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or. Plug in the amount of money youd like to take home. Median household income in 2020 was 67340.

What Are Marriage Penalties And Bonuses Tax Policy Center

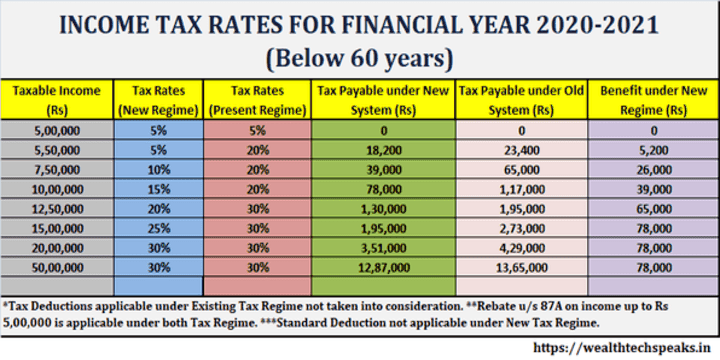

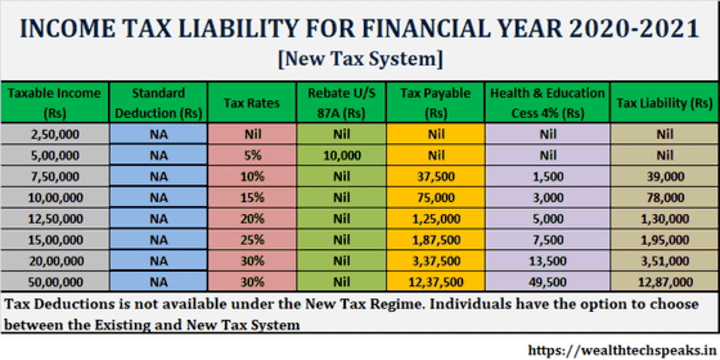

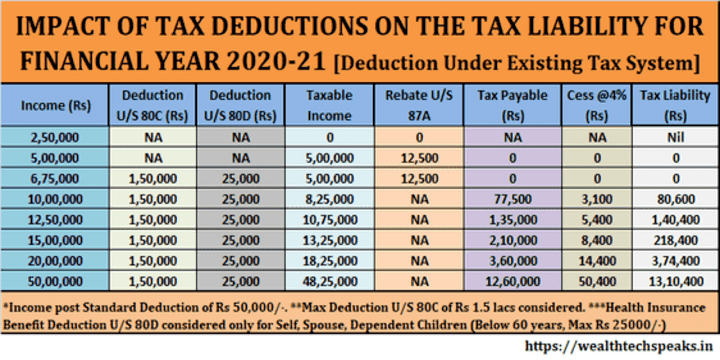

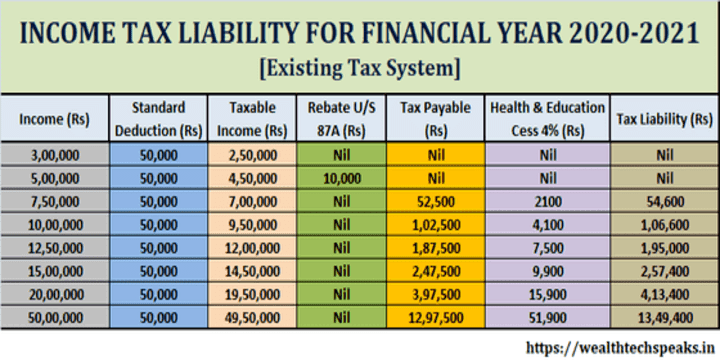

Income Tax Financial Year 2020 2021 Ay 2021 22 Tax Implications Wealthtech Speaks

Income Tax Financial Year 2020 2021 Ay 2021 22 Tax Implications Wealthtech Speaks

Income Tax Financial Year 2020 2021 Ay 2021 22 Tax Implications Wealthtech Speaks

Income Tax Calculation Formula With If Statement In Excel

Taxable Income Formula Examples How To Calculate Taxable Income

Pay Tax Calculator Shop 60 Off Www Prestigepaysage Com

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

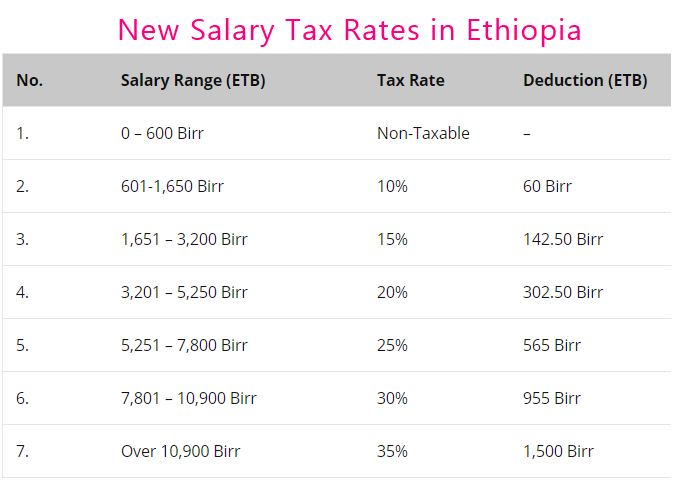

Salary Income Tax Calculation In Ethiopia Payroll Net Pay Pension Cost Sharing Calculator With Examples Addisbiz Com

Salary Formula Calculate Salary Calculator Excel Template

New 2021 Irs Income Tax Brackets And Phaseouts

Income Tax Financial Year 2020 2021 Ay 2021 22 Tax Implications Wealthtech Speaks

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Tax Income

Taxable Income Formula Examples How To Calculate Taxable Income

Income Tax Calculation Formula With If Statement In Excel

Provision For Income Tax Definition Formula Calculation Examples

Taxable Income Formula Examples How To Calculate Taxable Income